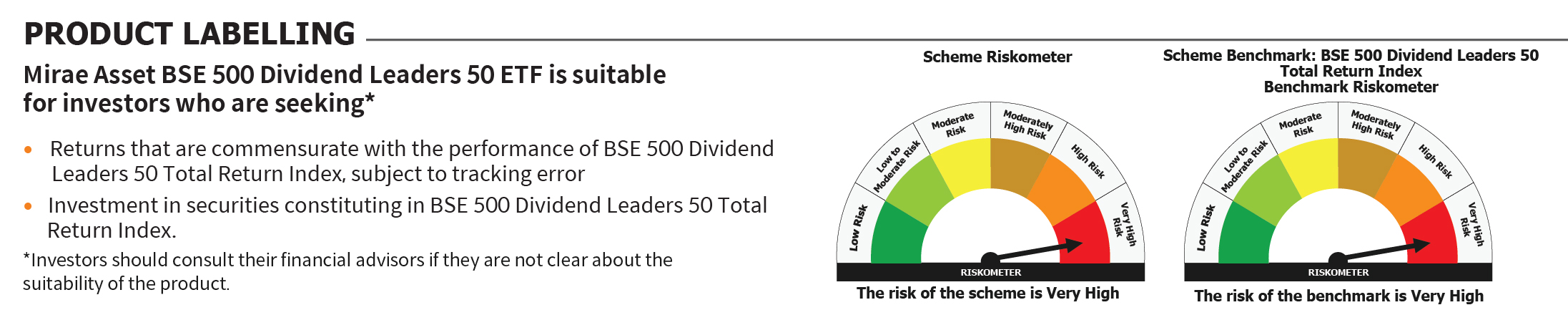

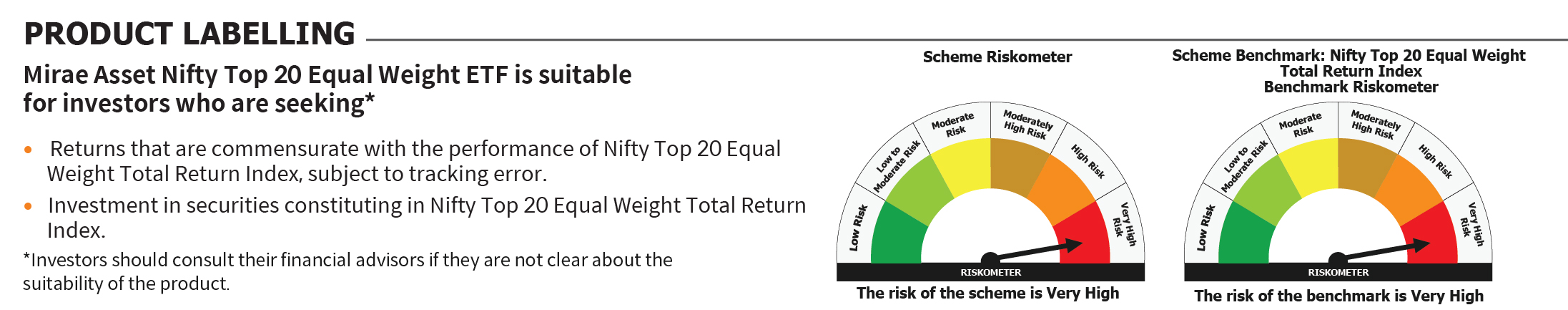

Mirae Asset Investment Managers (India) Pvt. Ltd. today announced the launch of Mirae Asset BSE 500 Dividend Leaders 50 ETF, an open-ended scheme replicating/tracking the BSE 500 Dividend Leaders 50 Total Return Index, and Mirae Asset Nifty Top 20 Equal Weight ETF, an open-ended scheme replicating/tracking Nifty Top 20 Equal Weight Total Return Index.

While the Mirae Asset BSE 500 Dividend Leaders 50 ETF provides exposure to companies that have demonstrated long-term consistency in dividend payouts, strong balance sheets and healthy cash flows—features that often reflect business quality and resilience, Mirae Asset Nifty Top 20 Equal Weight ETF provides an equal exposure to top 20 companies from Nifty 50 Index that command nearly half of India’s market cap and are leaders in several segments like Telecom, banking, automotive, infrastructure etc.

The New Fund Offers (NFOs) for the ETFs will open for subscription on December 02, 2025, and close on December 10, 2025. Both schemes will re-open on December 16, 2025.

“Dividend leaders seeks to offer a unique blend of stability and long-term wealth creation potential. These companies have demonstrated consistency in dividend payouts, sound governance and financial discipline. With the Mirae Asset BSE 500 Dividend Leaders 50 ETF, our aim is to offer investors a robust, transparent and relatively cost-efficient way to access high-quality businesses that can provide both steady dividend income and long-term growth.” said Siddharth Srivastava, Head - ETF Products & Fund Manager, Mirae Asset Investment Managers (India). “On the other hand, Mirae Asset Nifty Top 20 Equal Weight ETF is a play on the driving force of India’s growth. These market leaders anchor India’s financial, Infrastructure, IT, and consumption engines. The equal weight strategy helps in avoiding concentration risk seen in market-cap weighted indices.”

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada